The Retail Banking Institute provides independent professional education and certification for individuals and organisations in the exciting field of retail banking, the main source of profits for most of the world's banks.

Our programmes are delivered online or in-house by Retail Banking Institute faculty who are experienced industry professionals that understand the day-to-day opportunities and challenges in retail banking.

Our programmes are delivered online or in-house by Retail Banking Institute faculty who are experienced industry professionals that understand the day-to-day opportunities and challenges in retail banking.

Our programmes are delivered online or in-house by Retail Banking Institute faculty who are experienced industry professionals that understand the day-to-day opportunities and challenges in retail banking.

Since the establishment of Lafferty Group 40 years ago, retail banking has been our main focus. It is a fascinating sector with vast potential for future growth. Retail banking helps the world's consumers, small businesses, and the better off with their financial needs, from payments and savings to loans and investments. Investors love the sector, and stock market valuations of retail bank earnings are far higher than those of other banking sectors. We are proud to support the industry with education, knowledge, and intelligence.

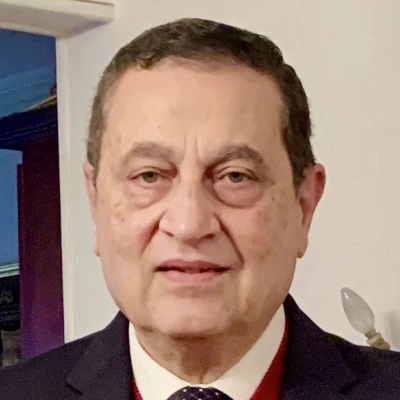

Michael Lafferty, Chairman

Discover the perfect programme tailored to your individual needs or company goals

Imagine the excitement of creating a modern, fully digital retail bank – a bank managed by real professionals that has more potential than all the fintechs in the world. A bank that knows how to cope with climate change from day one. A bank with an unwavering ethical foundation. This is the bank that the Certified International Retail Banker qualification is designed for.

Lafferty Group

Contact Us

E: enquiries@lafferty.com

E: caroline.hastings@lafferty.com

The Leeson Enterprise Centre

Altamont Street

Westport, Co. Mayo

Ireland

F28 ET85